How to Invest in Real Estate

Investing in real estate can be a lucrative venture, but it requires careful planning, research, and understanding of the market. Here are some general steps to guide you in the process of investing in real estate:

Educate Yourself:

Learn the basics of real estate investing, including different types of properties (residential, commercial, industrial), financing options, market trends, and local regulations. Read books, attend seminars, and follow reputable real estate websites to stay informed.

Set Clear Goals:

Define your investment objectives, whether it’s for rental income, property appreciation, or a combination of both. Determine your risk tolerance and investment timeline.

Create a Budget:

Establish a budget for your real estate investment, considering your financial capacity and potential financing options. Account for property acquisition costs, ongoing expenses, and potential maintenance or renovation costs.

Secure Financing:

Explore financing options, such as mortgages, loans, or partnerships, and choose the one that aligns with your financial situation and goals. Check your credit score and work to improve it if necessary. Identify Investment Opportunities:

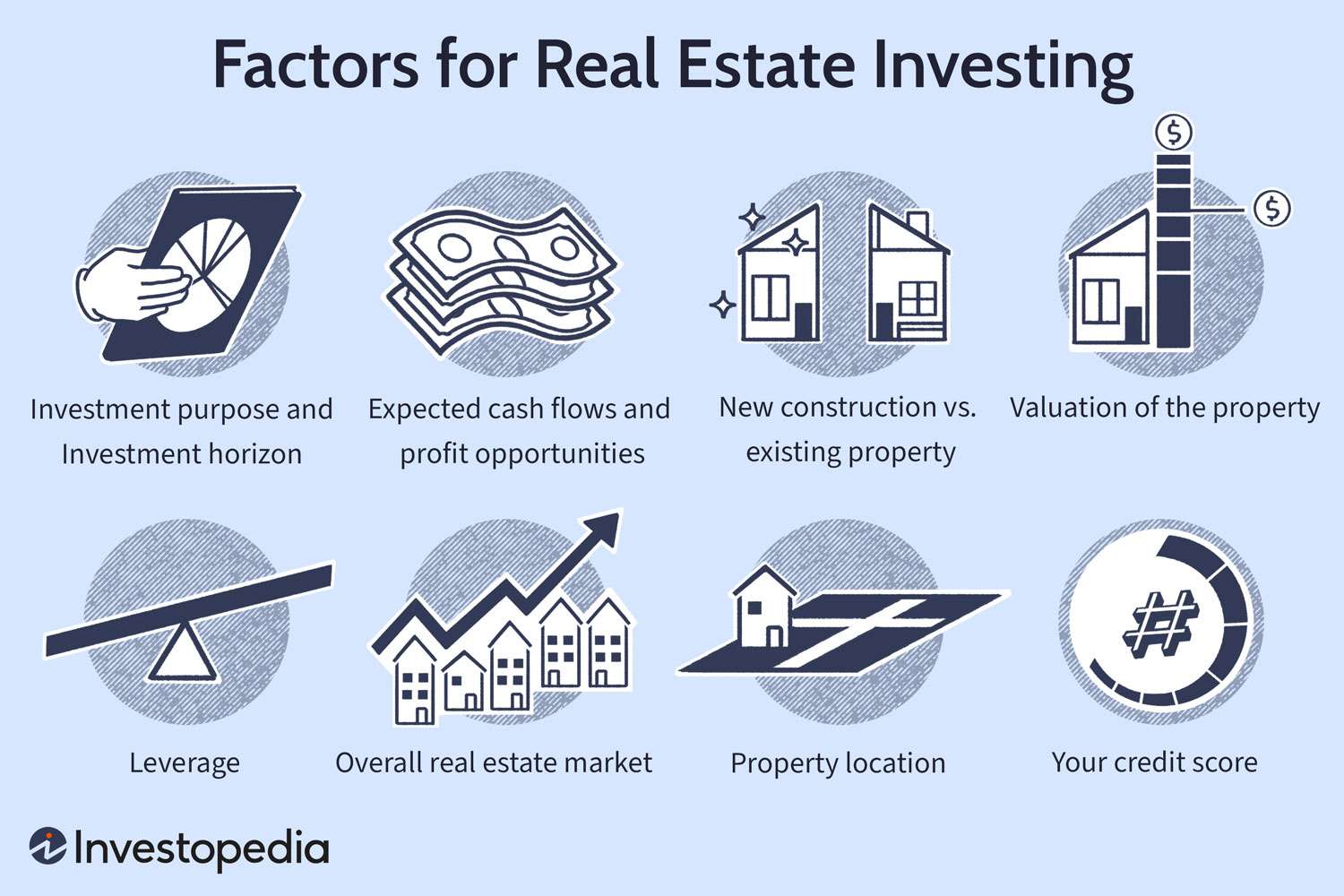

Research potential real estate markets and specific neighborhoods to find properties that match your investment criteria. Consider factors such as property value trends, job growth, population growth, and amenities in the area.

Conduct Due Diligence:

Thoroughly inspect the property for any issues, and consider hiring professionals like home inspectors or real estate attorneys to ensure you’re aware of any potential problems. Review local zoning laws, property taxes, and any restrictions that may impact your investment.

Make an Informed Purchase:

Negotiate the best deal possible based on your research and due diligence.

Ensure that the property aligns with your investment strategy and goals.

Manage the Property:

If you’re investing in rental properties, be prepared to manage tenants, handle maintenance, and address any issues promptly. Consider hiring a property management company if you prefer a more hands-off approach.

Stay Informed:

Keep yourself updated on market trends, changes in regulations, and economic factors that may affect your investment.

Diversify Your Portfolio:

Consider diversifying your real estate investments by exploring different types of properties or investing in multiple locations to spread risk. Exit Strategy: Plan for an exit strategy, whether it’s selling the property for profit, refinancing, or holding it long-term for rental income.

Remember that real estate investment involves risks, and it’s crucial to conduct thorough research and seek advice from professionals before making any decisions. Consulting with a financial advisor, real estate agent, or legal professional can provide valuable insights based on your specific circumstances.